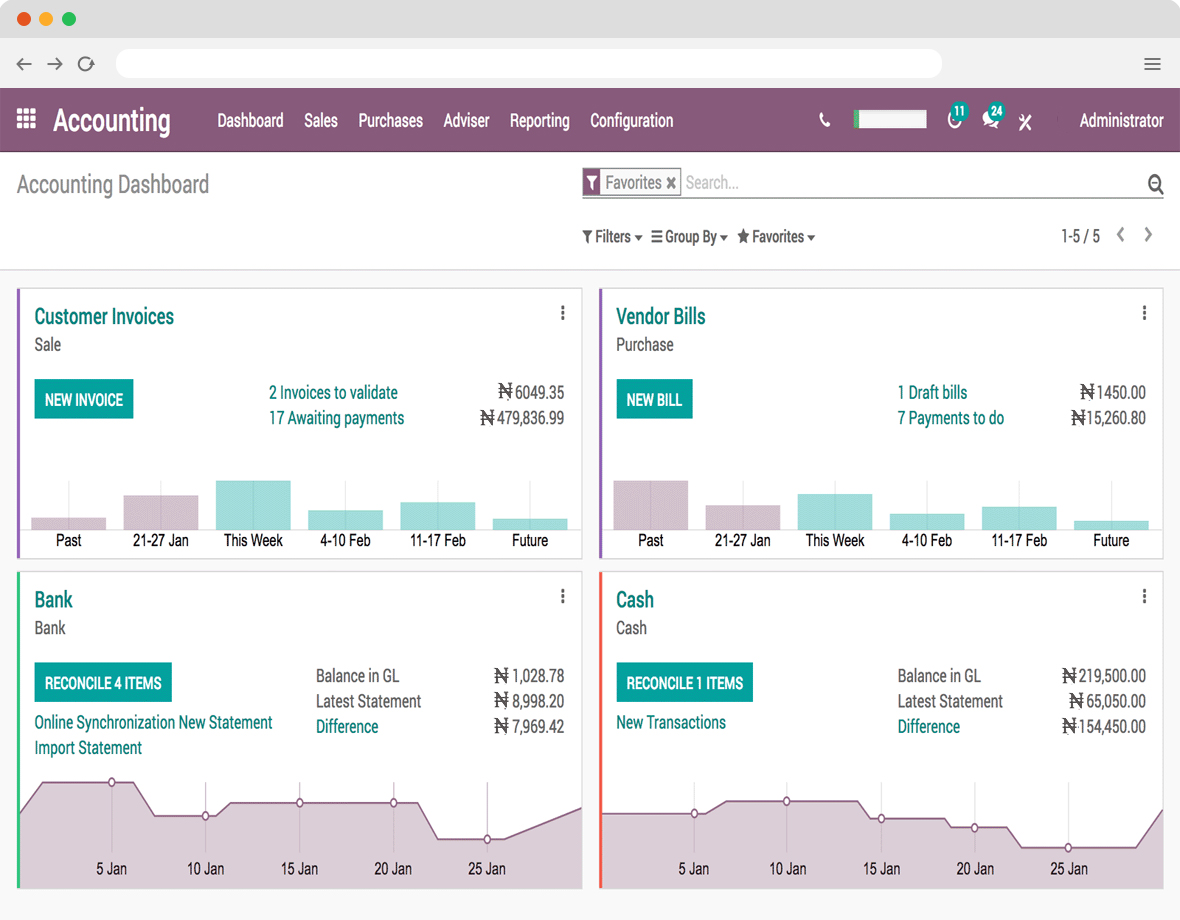

Excel3 ERP’s web-based Finance and Accounting software has everything you need, fully integrated into one complete system. The system deals with all formats for incoming and outgoing receipts, and all functions are fully integrated; from scanning, EHF, receipt, authentication, invoicing, banking, accounting and ledgers to reporting, with drill down to receipt level.

Excel3 ERP allows you to adjust receipt and work flow, customized to your business needs. Customers and accountants work in a single system, so you can take care of those tasks, linked to accounts and receipt flow, which are appropriate for you to resolve yourself. Of course, external accountants and auditors have free user access to the system.

Popular features that will change your life

All the time-saving tools you need to grow your business.

Bank Synchronization

Get your bank statements synced with your bank automatically, or import files.

Invoicing

Create sharp and professional invoices, manage recurring billings, and easily track payments.

Manage Bills & Expenses

Control supplier invoices and get a clear forecast of your future bills to pay.

Easy Reconciliation

Save time and automate 95% of reconciliation with our smart reconciliation tool.

Automation. Define our Workflow

The idea behind Excel3 ERP’s accounting software is, in brief, to make the incoming and outgoing receipt flow as simple and automated as possible. One business is not the same as another, and companies can customize their work flow and adapt procedures to their everyday needs. The system is also suitable for integration with other systems, so that unnecessary manual processes can be replaced with automated runs.

Inbound receipts. Go Digital

The invoice receipt module in Excel3 ERP handles and reads all invoice formats from electronic invoice to scanned invoices in PDF and JPG format. By entering a few settings for the supplier in the CRM system, both registration and entry of receipts into the accounts can proceed automatically. In order that incoming receipts are processed as efficiently as possible, we usually recommend the following to our customers:

Supply invoice via Electronic format

Supply invoice via Email

Travel and Expense Accounts

Travel and Expenses Accounts

The advantages of all three points mentioned above is that everything flows continuously straight to the recipient in the accounting system, without any unnecessary intermediaries or risk of manual errors on the recipient side. You thereby avoid problems such as slow processing of invoices and unnecessary reminders and fees. At the same time, this facilitates continuously updated accounting, where the Chief Financial Officer has full control over costs and payments, as well as reliable and correct data for management purposes.

Right Certification Flow

Easy Approval Policy

Continuous Invoicing. Improve Cash Flow

Compared, for example, with monthly customer invoicing, continuous invoicing can have a greater impact on liquidity and cash flow of a company than many realize.

Excel3 ERP makes continuous invoicing effective – using invoice templates customized to the businesses’ needs and profile. For example, through Excel3 ERP Mobile each employee can easily and continuously record their hours worked and basis for invoicing linked to a project. The basis for invoicing is thus automatically in place.

Keep track through Recording

Completely Integrated With Bank

Excel3 ERP is integrated with the banks, so that you or your accountant can run all payments directly from the system. All receipts and payments are automatically matched against the ledger in Excel3 ERP CRM.

Excel3 ERP makes continuous invoicing effective – using invoice templates customized to the businesses’ needs and profile. For example, through Excel3 ERP Mobile each employee can easily and continuously record their hours worked and basis for invoicing linked to a project. The basis for invoicing is thus automatically in place.

Efficient Accounting

Excel3 ERP enables simple transactions to be entered into the accounts with a high degree of automation. The system is structured with a high degree of flexibility, such that account entries can be made through the invoice receipt, approval or accounting modules.

The accounting module in Excel3 ERP is feature-rich and powerful – which means that it is designed to handle both basic and advanced accounting tasks. Thus you can freely define which columns you want in your layout and the order in which they are placed – from stamp number, invoice number, due date, period, customer number, project, department, VAT amount, sales tax, links, accounting templates, percentage deduction, foreign amount, currency, KID, bank accounts and self-defined dimensions to comments at receipt level.

To make accounting as efficient as possible, this module has access to a variety of hot keys.

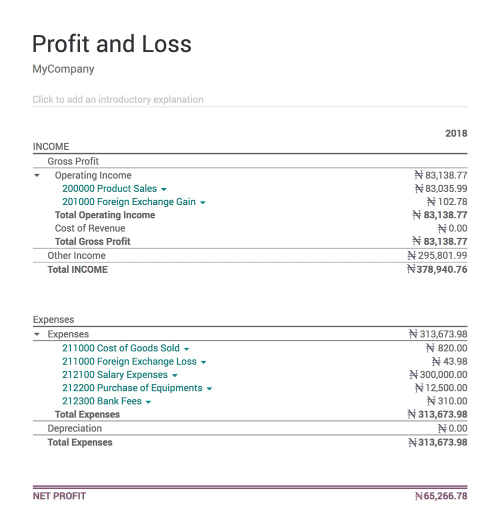

Beautiful dynamic statements

Your reports, the way you like them.

Easily create your earnings report, balance sheet or cash flow statements.

Quickly filter, zoom, annotate and compare any data.

Use business intelligence’s cubes to report across any dimension.

Using Accounting as a Management Tool

2In the Excel3 ERP model, we enable customers to handle those tasks which are most sensibly solved «in-house», customized to the resources and expertise of the business. Thus, from our viewpoint, businesses acquire better foundations and conditions for using accounting as a management tool.

With continuously updated accounting your business is able to base its management and decision-making on up to date figures, and not numbers pulled out of the deep freeze.

The system gives you an overview of your financial status through a variety of real-time reports from desktop, tablet and mobile. You can also build your own customized Dashboard with «widgets» for everything from key figures, most invoiced projects and customers, which sales reps have the highest sales in the current year,liquidity and balance to profit.

Work in the Same System as Your Accountant

Excel3 ERP allows customers and accountants to work transparently in a single system and in real time on a common, cloud-based, platform.

Some businesses keep a large part of their finance operations ‘in-house’ while others leave a majority of the task to their accountants. With our solution you can arrange work flow flexibly and optimally for your business – so you can take care of those tasks which are appropriate for you to resolve yourself, and use accountants where it is natural to do so. For example for accounting, reporting, year-end statements and consulting.

Your auditor also has free user access to the system.